“The Prime Directive is not just a set of rules; it is a philosophy … and a very correct one.” – Jean-Luc Piccard in Star Trek: The Next Generation

When you go to your doctor, you expect to get the best healthcare advice for your unique situation from your highly trained physician. The phrase “First, do no harm” comes to mind.

When you go to your CPA, you expect to get the best tax advice for your unique situation from a tax professional who is looking out for your best interests. When you go to your financial advisor, you expect to get unbiased advice for your unique financial facts and circumstances. You expect your advisor to act in your best interests, put your needs above theirs, and that they are legally obligated to do this all the time. If you were in Australia, the United Kingdom, or other parts of the world, this would be true.

However, in the United States of America, probably 85-90% of advisors do not have to provide this fiduciary obligation to their clients – at least on a full-time basis. The vast swath of the financial industry are brokers and sales representatives who operate under the suitability standard.

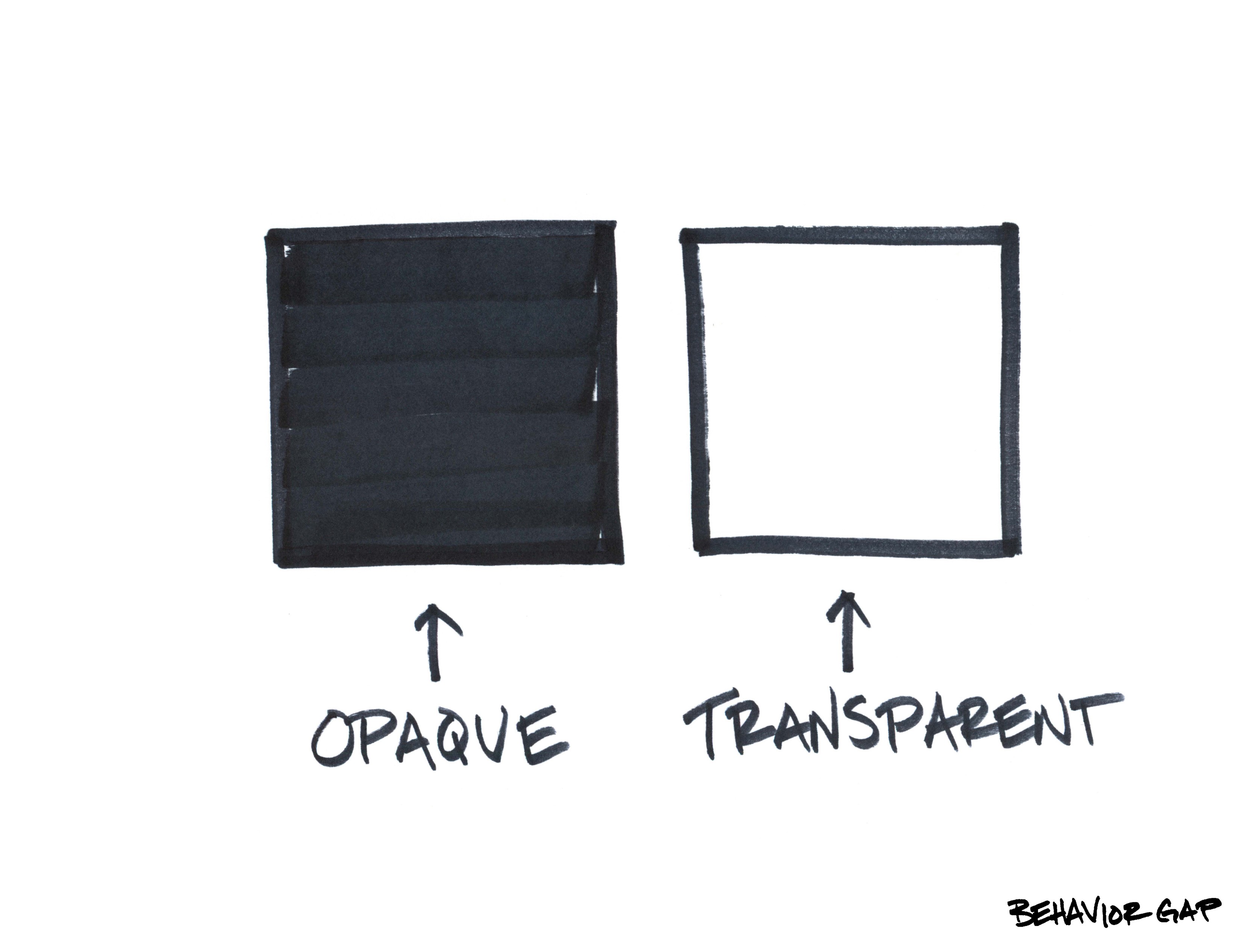

Different StrokesYou see two completely different standards that apply to people in the financial services industry. These standards are “fiduciary” and “suitability.”

Investment advisors must adhere to a fiduciary standard that was established by the Investment Advisors Act of 1940. This fiduciary standard requires them to always place their clients’ interests above their own. They have a duty of loyalty and care, which means an advisor must act in the best interest of his or her clients at all times. A fiduciary advisor must avoid conflicts of interest and must disclose any potential conflicts of interest in putting the clients’ interests first.

Broker-dealers and their sales representatives are held to the lower suitability standard. In the place of always putting the client first, the suitability standard merely requires the broker to reasonably believe that a recommendation is suitable for the client in terms of the client’s needs, objectives, and circumstances. The sales representative’s duty is to their employer and not necessarily to the client being served. Finally, the obligation to disclose conflicts of interest is not as strict of a requirement as it is for a fiduciary.

To add to the confusion, some financial advisors are “dual-registered,” which means they sometimes operate under the fiduciary standard and at other times they are under the suitability standard!

Source: © Behavior Gap, used with permission.

Danger! Danger!You should understand that there are lots of great suitability brokers out there doing a great job for their clients. Also, there are plenty of fiduciary-based registered investment advisors with less than sterling reputations.

However, the fact remains there are massive conflicts of interest and hidden agendas in the cold heart of the Wall Street brokerage and bank machine. Wall Street isn’t merely passing bags of cash around under tables and in dark alleys. Surely, there is language in all their paperwork about things such as revenue sharing, marketing allowances, third-party deals, and commissions, fees, overrides, bonuses, and sales contests.

It may be on page one in plain, conversational English. Most likely, it’s in subparagraph XZ of subsection J on page 43 of part IV of your customer agreement or some other form. Once you find it, you then must parse the legalese written in what appears to be ancient Sanskrit that says, in effect, “We like you, but we like getting paid a lot more.”

Bob Veres’ “More Dangers of Suitability” published in March 2019 outlines where consumers had their financial lives materially harmed by advice provided under the suitability standard.

- People sold index funds costing 1.5 to 2.5% per year when other funds are investing in exactly the same index for less than 0.10%.

- Others hire a dual-registered advisor who, while wearing his fiduciary hat, charges a fee for a plan and managing part of their assets. The same “advisor” then switches to his suitability standard hat to sell high commission variable life and annuities.

- Veres vividly details example after example of “the collateral damage that is being inflicted on American investors by sales agents in advisor clothing.”

Mr. Veres has graciously allowed me to share a copy of his article with you. Go to www.bit.ly/MoreDangers to get this valuable information that could protect you from harm.

All these backdoor deals are quite lucrative for the Wall Street brokerage firms and big banks. So lucrative that one large bank is offering up to 325% of a broker’s prior year compensation as a signing bonus!

Both Barron’s and Investment News ran stories on these huge recruiting bonuses, which you can find using these shortened web links www.bit.ly/BarronsBonus and www.bit.ly/InvNewsBonus.

The Mice Prime Directive My friend, Dean Jackson, taught me a great life lesson. According to Dean, mice have a simple prime directive in life: “Get cheese and avoid cats.” When it comes to getting financial and investment advice, I believe most investors have their own version called the “Rest Easy Prime Directive:” “Get unbiased advice and avoid salespeople.”

One simple step you can take to protect you and your own and keep to the Rest Easy Prime Directive is to look for a registered investment advisor (RIA) who is a full-time fiduciary. To help you, here are some questions to ask financial advisors:

Is the advisor working for an RIA that is solely compensated by charging fees to their clients? Is the advisor working for a brokerage firm or bank that makes money in lots of different ways?

Does the advisor’s firm have proprietary products? The name of the bank or brokerage firm may not even be in the product’s name. This is a common trick of the trade to have a bank or brokerage house with one name but then use a different name on their own financial products.

Does the advisor get paid different ways on different investments? If you are working with an advisor and they get paid more if you buy Stock Fund A than they do if you buy Stock Fund B, don’t be surprised when you get sold Stock Fund A.

When you find someone who will look out for your best interests, who does not have their own products, and gets paid the same no matter what you buy or sell, you should have more peace about your financial decisions and the advice they are based upon.

No one should expect to be sold a BMW when they visit the Lexus dealership. A mouse should not take a feline’s advice about attending the International Cat Show. And you shouldn’t think that the big Wall Street banks and brokerage firms are on your side.

Plan well. Invest wisely. Rest easy.

Hank Hankinson is the author of The Rest Easy Retirement. Go to www.RestEasyRetirement.com to get your free copy of the book and discover how to have a more successful and less stressful retirement. Hank, his wife Melissa, and their five children are residents of Reynolds Lake Oconee.